In 2025, digital transactions are the norm — and credit cards play a central role in this shift. With UPI support expanding and banks offering flexible reward systems, credit card usage has never been more convenient or more risky. That’s exactly why you need a Smart Credit Card Usage Guide for 2025 — to ensure you’re making the right choices while spending, avoiding common traps, and truly benefiting from your card.

Table of Contents

The Smart Credit Card Usage Guide for 2025 Starts with Awareness

Most people think credit cards are just a plastic version of a loan. But that mindset leads to problems. A credit card is not “extra money.” It’s a temporary borrowing tool, and if not handled wisely, it turns into a long-term burden.

A smart user doesn’t swipe blindly. They first understand what their card offers — cashback, points, discounts, lounge access — and then plan their monthly usage around these benefits. You don’t have to become a finance expert, but knowing what your card is good at helps you spend in a way that brings something back to you.

In this Smart Credit Card Usage Guide for 2025, we begin with clarity — knowing what your card does, how to use it within limits, and when to avoid it.

Use Credit Cards with Purpose — Not Pressure

Buying things you don’t need just to get a ₹200 cashback is not smart spending. A credit card should never tempt you to overspend. It’s best used when you already had to make the purchase — like a grocery bill, mobile recharge, or electricity payment — and your card gives you a reward for it.

Here’s how smart cardholders operate in 2025:

They set a monthly budget, and only use the credit card within that amount.

They never spend more than they can repay in full by the due date.

They choose categories — shopping, food, fuel — where their card gives the best returns.

Using credit cards without pressure allows you to benefit from reward points, offers, and other perks — without falling into debt or regret.

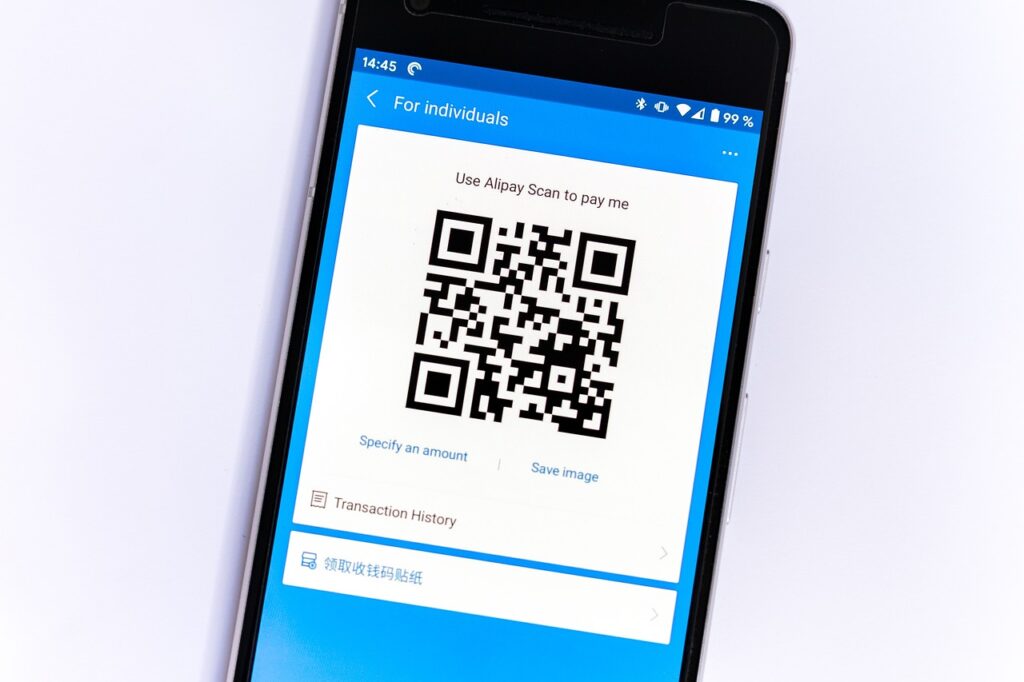

UPI and Credit Cards — A Game Changer in 2025

One of the most important updates in 2025 is the ability to link RuPay credit cards with UPI platforms like PhonePe and Google Pay. This means you can now use your credit card for UPI transactions at local shops, kirana stores, and even online payments — something that was impossible a few years ago.

But with this feature comes responsibility. UPI makes it easy to spend — just scan and pay — but it also removes the natural friction of swiping a card or entering OTPs. The Smart Credit Card Usage Guide for 2025 recommends that you treat credit-linked UPI just like real money. Track every UPI-credit transaction, check limits, and avoid emotional spending.

Avoid Minimum Payments — They’re a Debt Trap

Credit card statements often highlight a “minimum due” amount. While it may look attractive, it’s a trick. If you pay just the minimum, the bank charges interest on the remaining amount — and it compounds every month. Over time, even a small unpaid bill becomes a massive debt.

The correct way is simple:

Always pay the full bill before the due date.

Set up auto-pay from your savings account if needed.

Track spending weekly instead of waiting for the statement.

Discipline in repayment is the core of the Smart Credit Card Usage Guide for 2025. It builds your credit score, helps you stay debt-free, and saves you thousands in interest charges.

Use Offers and Rewards — But Only If They Match Your Needs

Banks and credit card companies often throw big words at you: “10x rewards,” “instant discounts,” “bonus points.” While some of these offers are truly valuable, many are designed to make you spend more than you intended.

A smart user always asks:

Was I planning to buy this anyway?

Will I use the reward or cashback that comes with it?

Is this offer limited to a specific website or brand I don’t use?

Rewards are great — but only when they align with your actual spending. The best users in 2025 don’t chase offers; they let the right offers come to them.

Final Thoughts — Credit Cards Are Tools, Not Traps

The difference between smart and careless credit card use is not about income or education — it’s about mindset. If you treat your card as a financial tool, you’ll get discounts, rewards, and convenience. But if you treat it like free money, it will quickly create financial stress.

This Smart Credit Card Usage Guide for 2025 isn’t about restriction. It’s about making the most of what you already have. Learn your card’s features. Spend only when it benefits you. Repay in full. And track your usage, especially when it’s linked to UPI.

With this guide, your credit card won’t just be safe — it will work in your favor.

Do Follow for daily news.